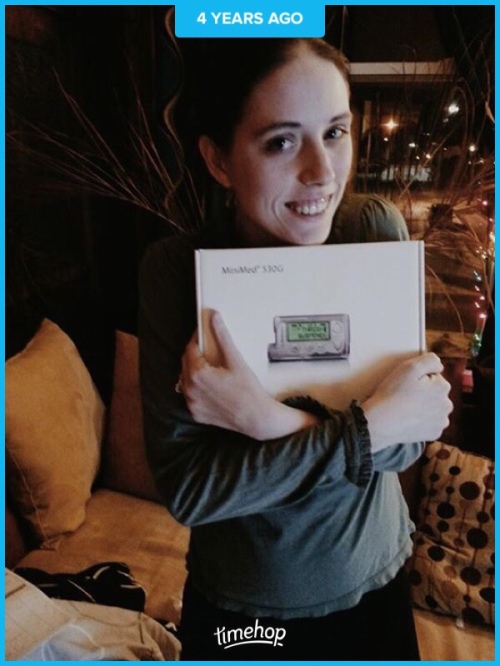

Four years ago, I got my first insulin pump, the Medtronic 530G.

After four years, your pump goes out of warranty. At that time, you’re able to upgrade through insurance. So, back in July, I began the process of getting my new pump even though I wasn’t out of warranty until December. (Of course, the Tandem rep laughed at me in July because it was way too early to even start paperwork or anything).

After 3 weeks involving 37 phone calls (no joke!), I finally have my new insulin pump in hand: the Tandem T-Slim X2.

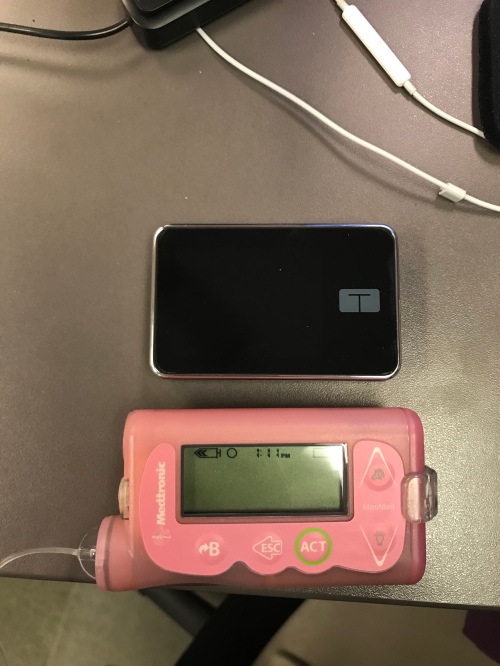

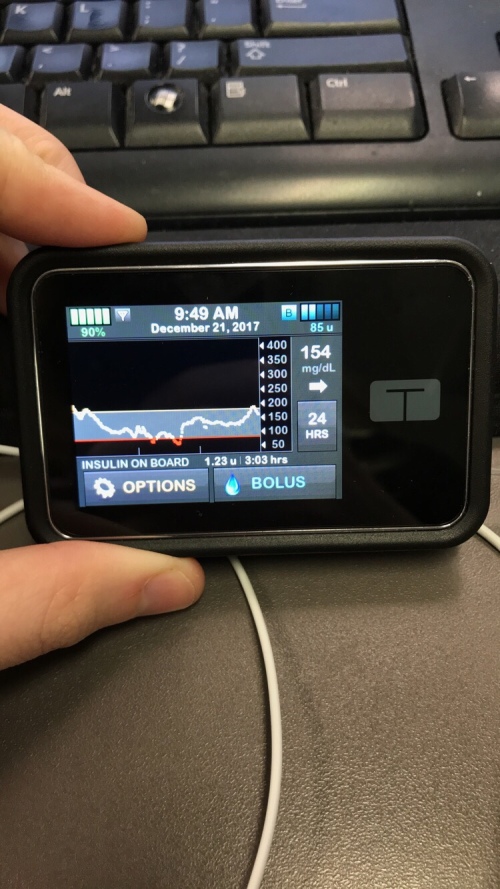

I’m so obsessed with this pump. It’s rechargeable so I don’t have to worry about always having spare AAA batteries on me. It syncs right with my Dexcom G5 so if my phone dies or gets misplaced, I can still monitor my blood sugar. It’s touch screen and doesn’t look like a damn pink pager.

After 2 days, here’s my impression so far:

The T-Slim’s more precise boluses are great, and although there are more steps for the bolus screens on the T-Slim and some people may find that irritating, I feel like it’s a good safeguard against accidental incorrect boluses

Medtronic’s menus are way more complicated and hard to navigate than the T-Slim’s are

T-Slim’s screen is bright and easy to read

The T-Slim primes so much slower than my old Medtronic pump did

Filling the reservoir/cartridge on the T-Slim feels more archaic than the Medtronic (since it uses a 2 piece syringe separate from the cartridge rather than Medtronic’s simple clip-it-on-the-vial setup)

Even with everything on vibrate, the T-Slim still audibly alarms when you’re starting a new cartridge, you’re below 55 mg/dL, and when you plug it in to charge (not so great when I’m at work in my quiet office) However the Medtronic also audibly alarms when you’re starting a new cartridge and also all the time when the battery is low, which happens after like 2 weeks and then you can run on a low battery for another 3 weeks-ish, so Tandem gets the point on this one

Tandem doesn’t have a Quickset equivalent so I have to use their Mio equivalent. I’m not a fan of Mios but I will get used to it eventually

The T-Slim’s case (and specifically the metal belt clip) feels so much more secure and heavy-duty than Medtronic’s flimsy plastic belt clip did. We will see how it holds up